The Deeper Dive: Is Project Zodiac's tax phase-in a good deal for Fort Wayne?

You've heard...

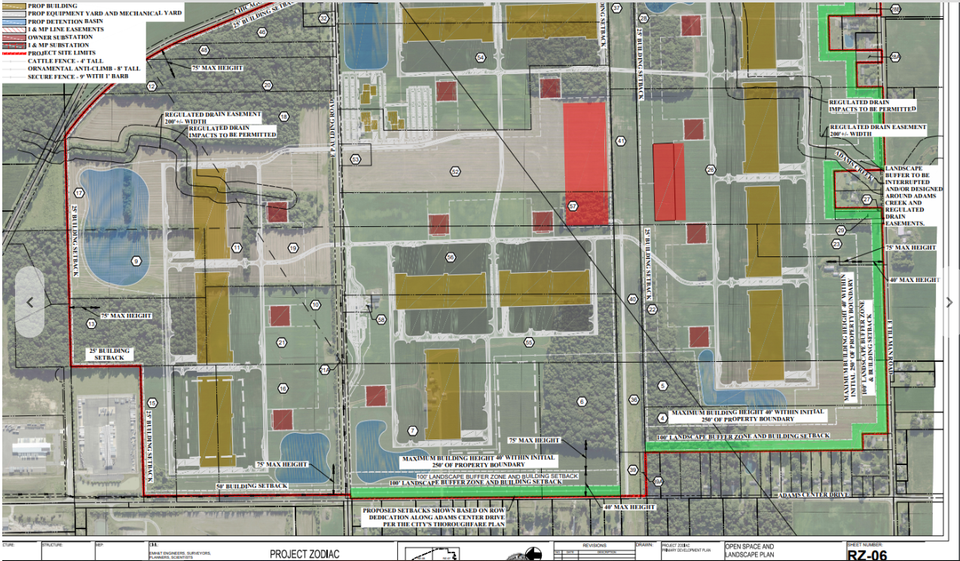

- This week: Fort Wayne City Council is considering a massive tax phase-in (aka tax abatement) request for the unnamed Fortune 100 data center campus, known as "Project Zodiac," slated for Fort Wayne's east side.

- Last week: developers with the project pitched a 50% deduction on their property taxes for 10 years in exchange for their projected $400 million investment, which is estimated to create 30 new full-time jobs with a $64,993 average salary, The JG reports.

- If approved by City Council: this tax phase-in would save the developer a total of $55.5 million over 10 years.

- Additional details: about the deal might be shared at tonight's City Council meeting, but were not listed on the agenda.

- Council will vote: on the deal during a special meeting with a public hearing on Friday, Dec. 22, at 9 a.m., if you can attend.

For a little background...

Tax breaks for businesses in Fort Wayne (and beyond) can be controversial topics.

- Nationally: State and local government expert Alan Greenblatt warns: "Study after study demonstrates that when states and cities give out tax breaks to companies looking to relocate or expand, they typically get very limited bang for their bucks, if any. Yet such incentives remain central to development strategies in most jurisdictions."

- For more local context: We spoke with City Councilman Geoff Paddock, who has helped shape the city's tax phase-in deals during his 12 years in office. “The subject is something that is something we deal with on an occasional basis, and there is some complexity to it,” he says.

In a nutshell...

- Paddock believes: tax incentives for businesses can be "a good tool, not only for jobs and economic development, but also because we see more property tax benefits as a result in the long run."

- For instance: When a company is building on previously underutilized land in the city, giving a business a tax break (or "phase-in" deal) on that land during a 5-10-year period may initially result in lower taxes for the business. But it can eventually result in more substantial tax gains for the city once those tax breaks "phase-in" (or wear off) and the land has a higher property tax value due to the company's investment.

- For this reason: Paddock and other representatives have worked to rename "tax abatements" to "tax phase-ins" as a way to let residents know that there is a return on investment once the phase-in period expires. "Tax abatement sometimes implies companies won’t pay anything ever, which is not necessarily true," he says.

- It's also important to note: Indiana law requires the company to pay Fort Wayne an "annual minimum payment" in property taxes even during the phase-in period. This rate for Project Zodiac is still TBA. “That will be explained to us at the meeting on Tuesday,” Paddock says.

Across the board...

- City Council considers multiple types of tax breaks for projects, including real estate property tax deductions, personal/business property tax deductions (on machinery and equipment) and other deductions for housing developments (as Councilwoman Michelle Chambers is proposing to increase the city's affordable and workforce housing stock).

- Tax phase-in deals: typically take place over 10 years, Paddock says, although five- and seven-year deals can be made.

- In the past: other Fortune 100 companies, like Amazon, have received real estate property deductions in Fort Wayne. But Amazon's business personal property abatement was voted down, Paddock notes.

So... is Project Zodiac's tax phase-in a good deal for Fort Wayne?

While exact terms of this deal are still unclear, three key takeaways from Greenblatt's research indicate how business tax breaks can work well for cities, in general.

1. Focusing on homegrown businesses versus attracting the next "Amazon" or "Google" tends to be the most sustainable economic strategy in the long-run.

- In Fort Wayne: Paddock says City Council doesn't necessarily factor in locality when making tax phase-in decisions. However, historically, most companies that have received tax breaks in Fort Wayne are from the local or regional area.

- In this case: Project Zodiac is not local, and he considers it a “super abatement” due to its scale compared to previous deals. “We’ve done something similar, but maybe only a time or two since I’ve been in office,” he says.

- Even so: he believes it's a worthwhile investment for the city due to its size and eventual return on investment, which will increase the value of currently underutilized land. "A $400M investment is huge for Fort Wayne, and if we don’t do it here, they might do it in the next city or state over," he says. "Personally, I’m not willing to risk the amount of jobs and eventual property tax benefits we will receive by not doing it."

2. Targeted tax incentives that build on existing industry clusters or strengths also tend to be effective for cities.

- For example: "The Oklahoma Department of Commerce has a program devoted to building the aerospace industry, using incentives to grow an existing industry known for generating good-paying jobs."

- Locally: Paddock says, if Fort Wayne votes to approve the tax break for Project Zodiac, it will be advancing Indiana's goal of attracting tech firms: "It is an industry we want to see here."

- Numbers-wise: the promised 30 new full-time jobs with a $64,993 average salary is higher than the city's average median household income of $58,233 (in 2022 dollars). That said, more jobs (and more high-paying jobs) will be key to making a meaningful impact on the state's tech sector.

- Paddock says: “I haven’t seen a formal package on it yet, but there will be substantially more than 30 jobs created as the 12-building campus builds out."

3. Methods of holding businesses accountable can help ensure that companies uphold their end of a tax deal in cities.

- For example: "Utah has an incentive program based on rebates. Once a company meets the criteria for receiving incentives — creating a given number of jobs that pay a minimum of 110 percent of the county average in relevant job categories, for instance — it gets a rebate."

- Locally: Paddock says Fort Wayne recently raised its filing fee for tax breaks to $1,000 to make companies think twice about applying. “Even more importantly, we put forward a more rigorous set of procedures for a company to qualify for a tax abatement," he says. (Namely, Fort Wayne requires companies to submit annual paperwork on time and maintain 75% of the investment they promised in jobs and payroll dollars to they city.)

- To hold companies accountable: City Council reviews active tax phase-ins annually.

- In 2023: the city had 140 active tax phase-ins for 97 businesses, and 17 companies did not comply to their ends of the bargain. Council terminated tax benefits for two companies.

- Paddock explains: “We’ve been more lenient with companies recently as many are still recovering from the COVID-19 pandemic and its effects on hiring.”

A statement from the City of Fort Wayne says:

On competitive projects such as Project Zodiac, consideration of incentives such as a tax phase-in by both the project owner and the local municipality is essential to the site selection process. To attract higher-than-average paying jobs and investment on the scale of this project, as a city, we have to be competitive with incentive packages comparable to those in other communities. We balance that with an analysis of the potential benefits to our community created by attracting new jobs and additional investment. Regarding accountability from businesses, the city currently has a tax phase-in compliance program that requires annual reporting from all companies that receive a tax phase-in. If a company has not complied with its commitments, the tax phase-in can be rescinded for non-compliance.

Watch or attend City Council meetings tonight and on Friday morning to learn more about the Project Zodiac deal and offer input.